Làm sao để người người ngoài mua nhà tại Việt Nam

- 19/10/2019

- 785

Buying apartment in Vietnam as a foreigner

Vietnam opened up to foreign investors in July 2015. Since then, the country has welcomed everything from corporations, property buyers, and stock investors, eager to capitalize on this exploding market.

We believe that Vietnam is one of the most interesting places for real estate investments in Asia at the moment.

Rental yields are among the highest, at the same time, you can pay as little as USD 1,500 per square meter for new condos in upcoming areas around Ho Chi Minh City.

In this article, We would like to share a lot of valuable information covering foreign ownership regulations, property taxes, the buying process, how you can get a mortgage, and more.

Can foreigners buy property in Vietnam?

Few foreigners have managed to invest in Vietnam real estate in the past. We can mainly blame unfavorable and strict foreign ownership regulations.

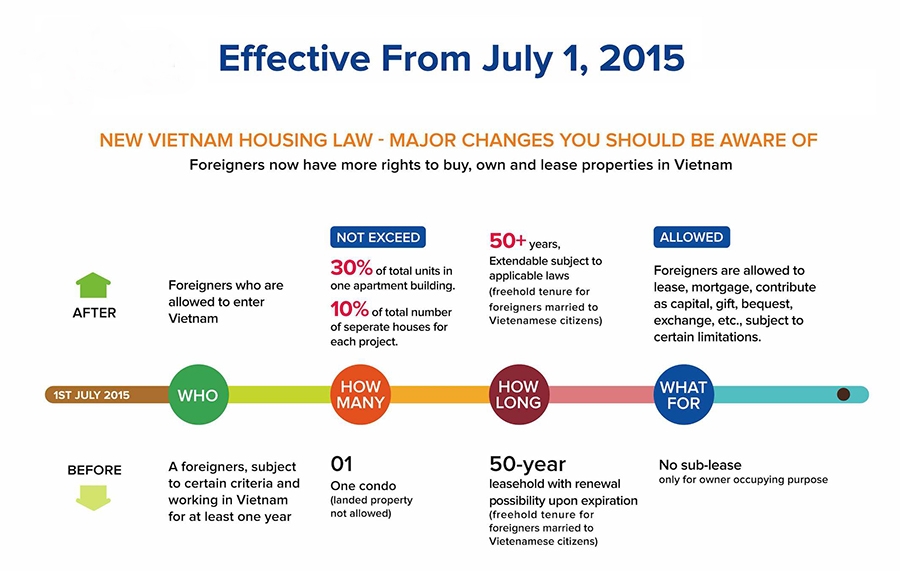

However, in July 2015, the Vietnamese Government introduced the Vietnamese Law on Residential Housing (LRH), which made it remarkably easier for foreigners to buy property.

Technically, you can buy as many units as you want, as foreigners currently don’t have any restrictions on the amount of properties they can buy.

Previously, the cap was set to a maximum one unit in a condominium. Thus, there’s been a drastic change in the regulations of foreign ownership.

Vietnam’s new law to foreign ownership of property

Below, I’ve summarized the most important information to take note of the new law:

- Foreigners can buy properties by simply possessing a tourist visa

- There’s no cap to the amount of properties you can buy

- Foreigners are restricted to buying a maximum of 30% of the units in condominiums and cannot own more than 10% of the properties in a landed project

- Foreigners can now buy houses, but only 250 of the houses in a given ward (division).

- The leasehold period is still 50 years but can be renewed

- If you have a Vietnamese spouse, you can get a freehold tenure

Can foreigners buy land in Vietnam?

Foreigners cannot buy and own land, like in many other Southeast Asian countries. Instead, the land is collectively owned by all Vietnamese people, but governed by the state.

As written in the national Land Law, foreigners and foreign organizations are allowed to lease land. The leasehold period is up to 50 years, but in some cases up to 70 years.

At the time I’m writing this article, the Government is considering to extend the leasehold period from 50 years to 99 years, which is positive of course.

Even if the regulations are getting less strict, and will probably loosen up over the years, you need to be careful. There’s no guarantee that you’ll be able to renew your leasehold period for example.

Vietnam’s Land Use Rights (LUR)

Thankfully, Vietnam has a law on land called Land Use Rights (LUR) that reduces the risks for foreigners to invest in Vietnam.

Even if you’re not allowed to own land, you have the right to use land – as stipulated in the LUR. It also gives you the right to control the land leased or allocated by the Vietnamese state.

Keep in mind that you need to submit a Land Use Rights Certificate (LURC) to the Vietnamese Government before you’re able to lease the land.

Can foreigners buy property from Vietnamese people?

Foreigners often buy property directly from developers on the primary market, or from foreigners that previously bought property on the primary market.

There are restrictions on the secondary market as you can’t buy property from local citizens in case the foreign quota is already filled (30%).

However, In Phu My Hung, District 7, The developer (Phu My Hung corp) supports Vietnamese owners to resell apartment to foreign buyers as long as the project still have quota for foreigners and the owner of apartment has not done paper work to have ownership certificate (pink book).

Vietnam ownership certificates of property

When you purchase a property from a developer, it’s important that you receive an ownership certificate. In 2017, foreigners had issues getting their property ownership certificates, this understandably caused some frustration.

So why did this happen?

According to law, foreigners cannot own properties in areas that are reserved to protect the national defense and security.

And it’s up to the Ministry of National Defense and the Ministry of Public Security to decide whether a property is located in an area that is reserved to protect the national and security.

I cannot stress the importance that you make sure that your prospective property can be owned by you as a foreigner, and confirm, before the purchase, that you will be able to receive the ownership certificate.

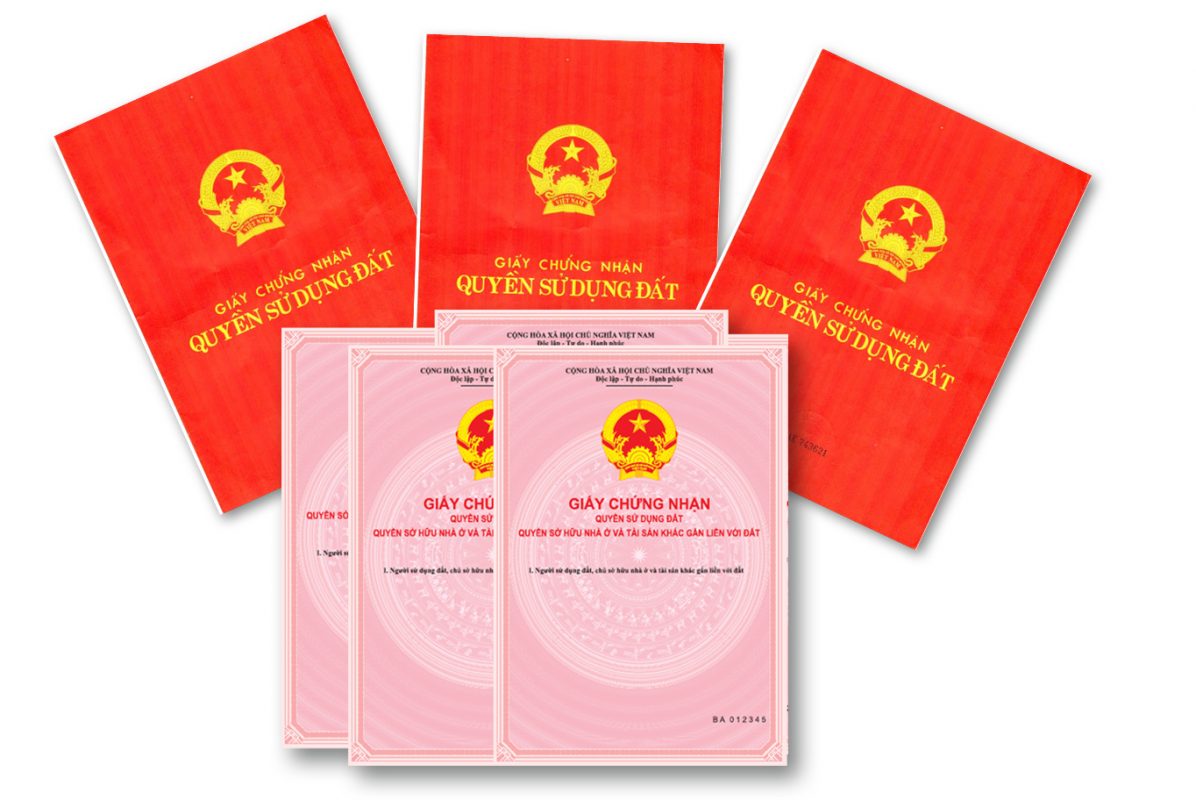

The pink book

The ownership certificate is often referred to as the pink book. The name comes from the small pink book that you should receive after you purchased a property.

The book proves your ownership and your rights of the property. It will give you the right to lease your property and declare information regarding inheritance, for example.

Shortly speaking, pink books are used for the title to verify the ownership of properties.

The red book

There’s also a red book that’s been used for a longer time than the pink book. The red book is used for the title to ownership of land, instead of physical structures, like houses and condos.

Thus, the pink book is more common for foreigners that normally invest in properties like condos, which are less regulated.

Do I need to receive the pink book when buying property in Vietnam?

Shortly speaking, the pink book is used for the title to ownership of property. Even if an SPA (Sales and Purchase Agreement) can be used to prove that you bought the property, the strongest evidence of ownership is to have both of them.

Remember:

- The pink book is considered the strongest proof of ownership, though it’s not a legal requirement to have one

- The SPA (Sales and Purchase Agreement) is equally, if not more, important

- With SPA, you can lease, sell or use your apartment legally. There is no problem to own apartment with SPA.

What does the pink book include?

The pink book declares that you can:

- Use your house for residential and other purposes

- Demolish, maintain, renovate or rebuild your house, if complying with the conditions and procedures of laws on construction

- Do transactions when selling, mortgaging or leasing the property

Process when buying property in Vietnam

Before you decide to invest in Vietnam, you need to understand the buying process. You don’t want any surprises or unknown fees to come up later in the process.

Below, I have made a list of important items you need to consider during the buying process.

1. Paying for a property in Vietnam

This is the initial step of the process, and an important one. Do you plan to pay with cash assets, housing loan or a combination of both?

In Vietnam, it’s common that locals pay (parts of the property price) with real gold, due to the volatility in VND (Vietnamese Dong). We can still see this in the secondary market, but a market you won’t engage in.

Nowadays, transactions are normally made in VND (USD can’t be used when buying property in Vietnam).

2. Why do you plan to buy?

You also need to ask yourself why you want to invest in Vietnam.

If you look for high appreciations, developing areas in Ho Chi Minh City can be a good choice, as it’s currently attracting a lot of foreign companies, expats and wealthy locals.

If you look for a beachside resort, Da Nang or Nha Trang could be better choices. Da Nang has experienced great increases in housing prices recently and gets heavily developed.

Buying one or several properties

If you seek high rental yields, you might be better off buying a multiple amount of units, especially in places like Ho Chi Minh City.

If you buy a multiple amount of units you can also diversify your risk.

3. Hiring a property lawyer in Vietnam

I recommend you to hire a Solicitor (lawyer)for larger transactions, and when buying landed property. The Vietnamese market opened recently to the foreign world, so there can be some roadblocks on the way.

However, foreigners rarely hire property lawyers when buying condos on the primary market. Reputable developers (like Novaland and CapitaLand) primarily build and manage the new condo projects you seen in Ho Chi Minh City.

You’ll find both local and foreign developers that are reputable, follow standards, and have managed dozens of projects in the past.

Normally, your estate agent or developer will involve a property lawyer where needed throughout the process.

4. Booking a property/condo

When your agent has helped you to find a project and unit you like, it’s time to pay a non-refundable deposit of VND 100 million.

The deposit is paid by credit card or bank telegraphic transfer, whereby you sign the Option to enter into Deposit Contract Agreement.

5. Pay the first installment & enter Deposit Contract

You need to pay the first installment within 14 days after you’ve paid the first deposit. The payment is managed by bank transfer.

When you’ve paid the first installment, you’ll enter into the Deposit Contract and the Deposit Contract shall be non-transferable.

6. Pay the following installments per schedule

Pay the following installments as concluded in the contract.

7. Sales & Purchase Agreement (SPA)

Drafting and execution of the SPA (if eligibility for foreign ownership is confirmed) and the SPA shall be transferable.

8. Handover of the unit

Before you can acquire the unit, you need to pay the maintenance fee (2% of the purchase value).

On top of the maintenance fee, you need to pay 1 year of management & operation charges, the registration fee (0.5%), and an additional installment.

9. Preparation for granting the pink book

When you’ve signed the SPA and managed your financial obligations, you need to submit documentation for the application to receive the pink book.

10. Final payment

Make a final payment within 14 days after you’ve taken notice to receive the pink book.

Transferring money to Vietnam when buying property

In general, you have three options when making payments:

- Open a local bank account at banks such as Vietcombank and Vietinbank. I recommend you to give them a call or send them an email before you go to Vietnam to see what they have to offer, and to clear all questions

- Transfer your money directly from your home country to another branch in Vietnam. There are international banks such as HSBC in Vietnam that can help you to do this

- Transfer money (VND) directly to the seller

At the moment, you need to declare any cash values that exceed USD 5000, when entering or exiting Vietnam.

Mortgages for foreigners in Vietnam

It’s been difficult, if not impossible, for foreigners to get mortgages in Vietnam.

Even if it’s still being restricted, you’re able to get property loans more easily from banks like OCB, HSBC and Standard Chartered.

At OBC, you’ll be able to get the following benefits as a foreigner (if you’re married to a Vietnamese spouse):

- A loan covering up to 80% of the property value

- A loan period of 15 years (so-called loan tenor)

To get a loan, you need to provide some collaterals such as proof of savings or other properties you currently own.

Shortly explained, collaterals are used to make sure that you can repay the mortgage in case you default.

Contact some local banks and see what they have to offer. The interest rate, amortization requirements and payback period are of importance to assure that you get the best loan.

Vietnam property taxes

Vietnam offers competitive real estate taxes. Below I’ve included the taxes you need to pay when buying property on the primary market.

VAT

The VAT is 10% when buying condominiums on the primary market.

Maintenance fee/sinking fund

A maintenance fee of 2% will also be paid by the buyer.

Registration fee

The registration fee is 0.5% and paid by the buyer.

Rental income tax

If you buy-to-let, you need to pay a VAT of 5% and a personal income tax of 5%. Thus, a total rate of 10% applies to your rental income.

Capital gains tax

Even if capital gains tax doesn’t exist in theory, you need to pay a personal income tax of 2% when selling property.

Land tax

Foreigners can normally not buy land, but the tax is 0.03 – 0.15%, just for reference. Consult with your agent or lawyer if needed, to confirm how to deal with the tax payments.

The best places to buy property in Vietnam

It’s not always easy to choose the right location when investing in a foreign country.

Here is the list of available apartments for sale to foreign buyers in Ho Chi Minh City. Please click here to see details: Listing of apartment for sale to foreigner

To have specific advises, please feel free to contac us Co.,LTD

Co.,LTD

Hotline support 24/7: +84 908 280 293

Tel: +84 5413 2929

Email: info@prohouse.com.vn

Website: www.prohousevn.com or www.prohouse.com.vn

Address: 56 Street no 17, Phu My Hung, Tan Phu ward, District 7, HCMC.

Branch 1: ProHOUSE Tan Binh, PBP1-10 Botanica Premier, Hong Ha street, Tan Binh ward, Tan Binh district

Branch 2: T1A-03-06 Linden Residences, Empire City, Mai Chi Tho street, Thu Thiem ward, District 2